I suggest that it be lowered in the future when network usage increases. Not right now.

To keep things organized, the second proposal has been moved to its own thread.

If you want to discuss the proposal about [Proposal: Balanced Inflation Strategy for Massa (Alternative Path)] please use the new topic here :

![]() https://forum.massa.community/t/proposal-balanced-inflation-strategy-for-massa-alternative-path/257

https://forum.massa.community/t/proposal-balanced-inflation-strategy-for-massa-alternative-path/257

Let’s keep one proposal per thread to make discussions easier to follow, thanks !

Since this was proposed for MIP and heavily discussed, I wanted to give an opinion as the president of Massa Labs,the software development company behind the Massa node.

Massa Labs staking transparency

As of April 22nd, 2025, Massa labs is staking with the following accounts:

- AU12Vi9V6Fsq9HMh9ge88WJ5cgymBGc3oUX2F6WpRqA5HdabPcPt5 => 81,101 Rolls

- AU128Rexxftc1jYhyouTesxjPqeezEHh5LUAzNaAfqDo1dWRgPH8m => 10,000 Rolls

- AU12L4gaQ8j8j5yBt2jSmcsmu51yZW2gLjnZr5rAWnjKJDNacR3jp => 42,263 Rolls

Total: 7% of the active total stake at the time.

Position

Technical assessment

Technically speaking, the proposed constant change does not cause any technical issues with the node, and is within reasonable bounds security-wise. The only thing to know is that the 1.02 MAS block reward was chosen to be divisible by 17 without generating too many decimals. A value of 0.4 will cause values like 0.023529412 MAS to be given to producers. But this is purely cosmetic.

Alignment with our goals

Giving more rewards to stakers means that the chain seems more attractive for node runners on the APY side, and node runners are a core part of the Massa ecosystem. However, the value that node runners cash out to pay their expenses and make profits is actually taken from non-staking users, and pushes the token price down. This also means that the stakers who dump more damage the value of the token for the ones who hold. The staking APY is comparatively high, and would remain compelling for node runners after this change if accepted.

We stand by our position: we want to stimulate the active usage of the blockchain by acquiring more users without hurting node runners and holders. For this, we believe that less value should be taken away from non-staking users. Acquiring new users is easier with less constant value loss for them, and a better-looking token price graph.

This of course is not enough to acquire users, and should be combined with outreach and marketing strategies, but at least it sets a more attractive basis to make those efforts more effective and successful. A successful user acquisition strategy would result into a general increase in overall node runner profits in a healthier and more durable way.

Vote

Massa Labs will vote in favor of the proposal.

That is about 13.39% with 0.4 today. Same APY as some different blockchains have, like STARKNET. They have lost about 80-90% of their value in one year, the same as Massa. It’s only gonna benefit private, seed round investors and the team. Newcomers are buying from the market.

As an alternative to this proposal, I submitted to the governance: Dynamic inflation

My rationale: Dynamic inflation - #21 by curiosithy

Governance proposal: https://mip.massa.net/proposals/2

Hello!

The Massa Foundation will also support this proposal. For transparency: the Massa Foundation is staking 24.2% of the rolls now.

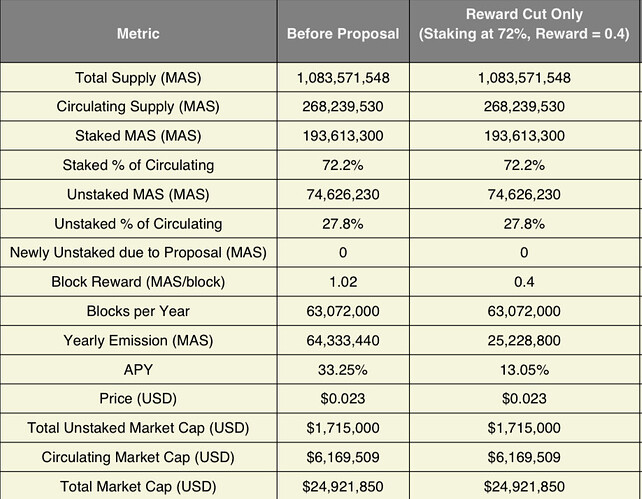

The total supply inflation is right now about 63m MAS per year, approximately 5.8% of the total supply, and 33% of the staking supply. The staking APY is thus 33% now, and will decrease to 13% with this proposal (these APY numbers do not account for token price fluctuations).

We believe the current APY is too high at this stage of the project, and is one of the factors of the quickly increasing circulating supply, of the non-staking holders dilution, and is an overall source of token dumps.

With a 13% APY, more in line with the majority of other protocols, we think this proposal will have a positive impact on the value of the protocol and on stakers in particular, whatever their size, when we factor in the scarcer supply.

This being said, we will monitor the staking reward opportunity for very small nodes and see how we can further help them participate in the decentralization of the network (1,000+ stakers at this time!).

Hi Damir, this concerns Seb as well,

I want to address the core argument made by the Foundation and Lab that reducing staking rewards is necessary to “protect value.” That claim doesn’t stand up to scrutiny, especially considering the current distribution of stake and the complete lack of any economic modeling to support it.

The daily staking reward is 168,000 MAS, which translates to roughly 5 million MAS per month. Even if the entire 69% of that supply held by the community were sold daily, it’s highly questionable whether this would have any significant price impac, particularly at a current price of $0.024. That’s just over $82,000 worth of tokens monthly, spread across two exchanges. The idea that this alone is suppressing MAS’s value lacks credibility.

More importantly, there are no statistical models, no on-chain behavioral analysis, and no concrete evidence presented to justify this move. The community was asked to vote on a proposal that seems driven by internal team motivations, not by transparent data or collaborative input.

If the economic argument can’t be backed by serious modeling, then what exactly are we basing this decision on? And if the vote was always going to be pushed through by entities with outsized governance control, then what was the point of involving the community at all?

This entire process feels like a departure from the decentralization Massa claims to champion…

This is a question worth pondering, and I strongly recommend that the Massa team conduct some actual data model analysis. Let’s discuss this issue at the end.2025-05-14T16:00:00Z

Some actual data analysis from the team would be welcome especially after claims about

Given that these aren’t just random community opinions but statements from key figures behind Massa, the burden of proof has to be higher. If proposals like this are going to be pushed through without proper economic modeling or on-chain analysis, then realistically, the foundation and lab could arbitrarily justify any change they want.

That’s not how decentralized governance should work. If we’re going to alter core mechanics like staking rewards, the reasoning should be transparent, data-driven, and open to real debate, not just assertions.

The choise of making 1.02 MAS divisible by 17 was good and intentional. I suggest, for the same reasons, if this proposal is passed, the value of 0.4 be slightly adjusted to be divisible by 17. The proposed adjustment are:

- 0.408 → 0.408 ÷ 17 = 0.024 (the result will have three decimal places)

- 0.4012 → 0.4012 ÷ 17 = 0.0236 (the result will have four decimal places)

- 0.40001 → 0.40001 ÷ 17 = 0.02353 (the result will have five decimal places).

Therefore, if this proposal is voted YES, at the technical implementation, I recommend setting BLOCK_REWARD=0.40001 as it will likely have negligible effect on the overall annual reward and at the same time will make the value divisible by 17 to avoid large number of decimals.

Hello! Thank you for going through the numbers. Indeed at the current price, it would lead to ~80k monthly. Based on market making experience, we believe this is not negligible at all. Even more at higher prices, e.g. at $0.05 last February, it becomes $150k, and so on as the price increases.

Please respect the initiative and motivation of other people in the community (people like you), who created this topic, then created this proposal, with which we and others happen to agree.

Please also respect the work we did with Massa Labs devs, designing an on-chain voting protocol solving the problem with this kind of proposals: how do we know if the overall community is more for or against when we see both types of messages ? Only by voting. This is a departure from taking block reward decisions myself on my own.

The process can be improved with your feedback. Yes we could do more on-chain analysis of this and that (anyone can btw), but now we prefer focusing our time on user acquisition and partnership work. Yes the voting power of the Foundation is going down month after month as new people start staking. Also, I have seen no serious modeling arguments showing we should keep the current APY rate above 30%.

I have no problem with this. If the technical implementation someday is too far away from a proposal, I would recommend to make another proposal and vote again. We can do the same when proposals are not precise enough in the first place and can be interpreted in different ways.

Hi Seb,

Thanks for your comment. I’m not necessarily looking to debate every point here, but rather to highlight what I see as critical flaws in the reasoning and justification you and Damir have offered for your votes on this proposal. My goal is to clarify my position for others.

That is still just an assertion. Where are the numbers? Where’s the liquidity modeling, the slippage data, or any quantitative analysis showing that staking rewards are actually creating consistent downward pressure on price?

I absolutely respect the efforts of those who created the proposal. What I can’t get behind is a process where two entities Labs/Foundation control 31% of governance power and are able to a dangerous degree alter the the outcome of any vote without providing arguments backed by data.

This is a textbook example of centralized control masquerading as community consensus. There was no accompanying economic report, no modeling, no transparent rationale, just assertions. That’s a dangerous precedent.

To draw a comparison for you to better understand my point: when Ethereum adjusted issuance in EIP-1559 and later reduced block rewards, the Ethereum Foundation and core devs published detailed simulations, impact forecasts, and openly debated the trade-offs. The process involved transparency, modeling, and broad discussion.

Nobody expects Massa to operate at Ethereum’s level and rigorousness but a bare minimum level of justification is a must for any blockchain that does not want to represent itself as a Masters/PhD level side project.

That’s understandable; however, user acquisition is not a substitute for sound protocol design and it is especially not a justification to abandon data arguments.

I agree with you that if the technical implementation results into significant modification of the voted value, another vote has to be made. However, for the case of this proposal, which I am glad it have been accepted, in my opinion, there is no need of voting. The variation from BLOCK_REWARD=0.4 to BLOCK_REWARD=0.40001 is very technically and mathematically acceptable.

I actually submitted this proposal months ago and completely forgot about it, especially since I sold all my MAS holdings for personal reasons that had nothing to do with Massa’s future or potential. A few days ago, I noticed an email and saw that the discussion had picked up. Honestly, I did not expect it to gain much traction.

Let me be very clear: I am not affiliated with the Massa Foundation, the Lab, or any internal team. I am an independent member of the Massa community, and I submitted this proposal based on my research and belief in Massa’s long term success. I currently hold zero MAS.

Now let me directly respond to your points:

reducing staking rewards is necessary to “protect value.

That claim ignores basic economic logic. High inflation destroys long-term holder confidence. Price is not driven only by immediate sell pressure, it is also driven by expectations.

That’s just over $82,000 worth of tokens monthly, spread across two exchanges. The idea that this alone is suppressing MAS’s value lacks credibility.

You are focusing only on dollar volume, but markets are psychological. Continuous daily selling from rewards gradually erodes price and pushes long-term holders away. In Massa’s case, short-term stakers profit by constantly dumping rewards onto long-term holders( the people who actually believe in the project and hold ). But if the price keeps dropping due to high inflation, those long-term holders lose faith and exit. Then what? Eventually, stakers are left selling to no one.

no statistical models, no on-chain behavioral analysis, and no concrete evidence presented to justify this move

With respect, this is a weak argument. Massa has very limited on-chain data, almost no DeFi, and no complex behavioral metrics to study yet. So what exactly is there to analyze?

Driven by internal team motivations, not by transparent data

Ironically, I am not part of the team, and I have nothing to gain. I do not hold any MAS. I simply proposed what I believe is economically sound, based on experience and precedent.

then what was the point of involving the community at all?

This is a contradiction. You argue that it both lacked support and passed too easily. Which is it? In fact, the proposal did receive community engagement and discussion, this is what decentralized governance is about. If you disagree, you are absolutely free to present a counter-proposal with your own emission model. But attacking a proposal just because it received support is not valid criticism.

FYI : I have also made a similar proposal before. In 2021, I submitted a proposal to Kadena to revise its emission model. It was adopted, and shortly afterward, Kadena’s price surged from $0.30 to $28. This real-world example shows how properly tuned tokenomics can directly impact market confidence and long-term value. Update to Kadena Token Economics | by Will Martino | Medium | Kadena

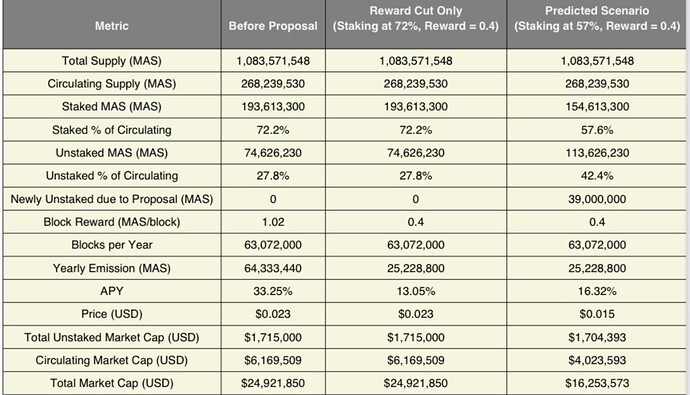

Predicted scenario :

I expect community staking to drop from 72% to 50% within the next 2–3 months due to the block reward cut from 1.02 to 0.4 MAS and the reduced APY from 33% to 13%. Massa Foundation and Massa Labs are expected to maintain their current stake levels, which will decrease the overall impact.

As a result, total staking will decline to approximately 57% & 39 million MAS will be unstaked and return to circulation, and APY will increase to 16%

This increase in circulation supply will likely push the price down to a short-term bottom of around $0.012–$0.015. However, as the market stabilizes, long-term holders accumulate, and selling pressure from staking rewards remains low, the price will enter a recovery phase over the following 4 to 12 months.

With improved adoption, community growth, and ecosystem development. I expect MAS price to recover and potentially reach a new all-time high.

NFA

Hey,

For transparency: the Massa Foundation is staking 24.2% of the rolls now.

Total: 7% of the active total stake at the time.

They also represent 31% of stakers ⟶ Voters on proposals.

While Massa’s primary focus is decentralization, I don’t think this digit is a good metric for that.

More importantly, there are no statistical models, no on-chain behavioral analysis, and no concrete evidence presented to justify this move. The community was asked to vote on a proposal that seems driven by internal team motivations, not by transparent data or collaborative input.

I agree.

token unlocks will still introduce supply-side pressure

It’s more dangerous than high staking rewards.

The Core Issue: Adoption and Utility

Indeed.

Finally, with the reduced block reward, the project risks becoming even more centralized—small stakers likely won’t be able to cover server costs and will gradually abandon staking altogether.

Hello,

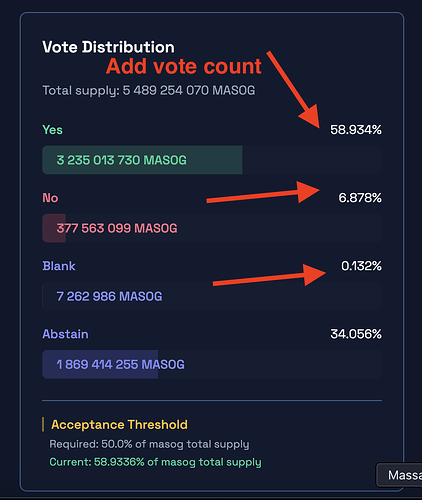

The reason why we did not add vote counts there is the same as why we didn’t use vote counts for votes themselves: they are effortlessly fakable.

A single person splitting their rolls among many addresses would completely skew the counts.

Displaying those counters could make people believe they are reliable.

This was used by some teams to boost their numbers artificially, but we are not interested in that.